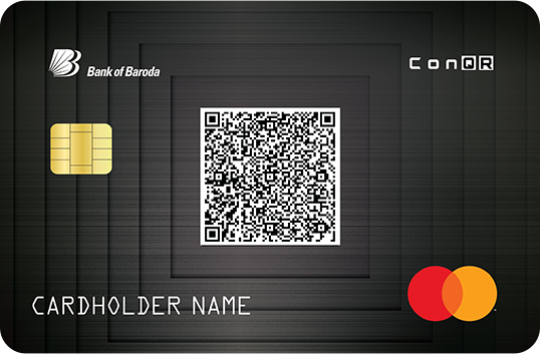

with Bank of Baroda ConQR Credit Card

The first of its kind globally, The Bank of Baroda MasterCard ConQR Credit Card is equipped to help you meet your business needs and make you conquer your business world.

Using this 2-in-1 card, you can accept payments from your customers through Bharat QR printed on card front, and also can make payments for all your purchases with free credit period of upto 50 days.

Know your card benefits

SPEND REWARDS

SPEND REWARDS

TRAVEL & STAY DELIGHTS

TRAVEL & STAY DELIGHTS

HEALTH & BUSINESS SECURITY

HEALTH & BUSINESS SECURITY

Your reward kitty is still gleaming

Fuel Surcharge Waiver**

1% Fuel Surcharge waived off on all fuel transactions between ₹400-₹5000. (Maximum waiver of ₹250 per statement cycle)

SMART EMI option

Convert purchase of ₹2,500 on your card into 6/36 months EMIs

In-built insurance cover

Get FREE Personal Accidental Death Cover to ensure financial protection of your family. Air: ₹15 Lakhs, Non-Air: ₹5 Lakhs

*Refer reward points important terms and conditions on MITC Section of the website.

** Reward Points are not earned on fuel transactions.

Enjoy the 2-in-1 credit card that offers dual benefits with ZERO

Joining & Annual Fees.

Save time & fast track your application

Eligibility Criteria

Eligibility Criteria :

Primary cardholder between the age of 18 years and 65 years

Sole proprietorships establishments where BOB POS machine has been installed.

Resident of India

Documents Required

Documents Required :

Kindly keep soft copies of the below documents ready for submission, when you apply online.

Passport size Photograph

PAN Card

Shop Registration Certificate - Attested copy (verified against original) of shop establishment registration. Sales tax number/TIN no. should be mentioned with proper establishment name & address.

Current Address Proof as per the defined list of OVD/deemed to be OVD. (Passport, Voter Id, Driving License, Aadhar Card).

Annual Fees

Annual Fees :

| Fees/Charges | Primary |

|---|---|

| First Year Fee (levied in the first statement) | Lifetime FREE |

| Annual Fee | Lifetime FREE |

Please call 1800225100 for all Credit Card related queries and 1800223225 for QR code related queries