Q.

Q.

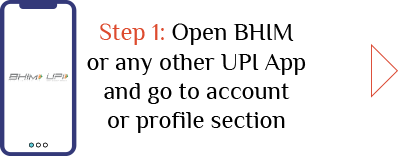

What are the prerequisites for linking Bank of Baroda RuPay Credit Card on UPI Payment app?

A.

Bank of Baroda RuPay Credit Card PIN needs to be setup before linking on UPI apps. Bank of Baroda Credit Card PIN can be setup through our portal, mobile app, or through IVR by calling toll-free number printed on your RuPay Credit Card.

Q.

Q.

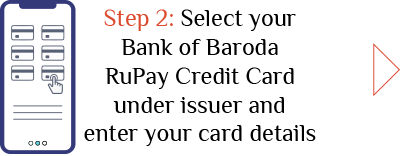

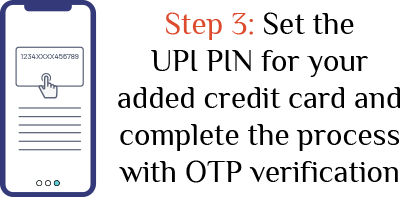

Will I have to set UPI Pin or I can authenticate transactions using Card pin?

A.

You will have to setup UPI Pin to authenticate this transaction.

Q.

Q.

Can I change my UPI Pin?

A.

Yes, you can change your UPI pin of your respective RuPay account

Q.

Q.

How can I make payment to a retail offline merchant using Bank of Baroda RuPay Credit Card on UPI?

A.

Retail offline merchant payment can be done using following steps -

- Add your Bank of Baroda RuPay Credit Card to the UPI app

- Open UPI app on your mobile, click on Scan.

- QR scanner will open on UPI app, scan the QR, enter the amount

- Select Bank of Baroda RuPay Credit Card from the drop-down menu

- Confirm the payment by entering UPI Pin.

- Payment confirmation will be displayed, once the payment is done.

Q.

Q.

How can I make payment to an e-commerce merchant using Bank of Baroda RuPay Credit Card on UPI?

A.

Please follow these steps to make ecommerce merchant payment -

- UPI Payment can be made at all e-commerce merchant accepting payment through UPI

- At the time of check-out i.e. while making payment, please select UPI app as payment mode at merchant website or mobile application.

- Login into UPI app, select Bank of Baroda from the drop-down menu

- Confirm the payment using UPI Pin.

- Payment confirmation will be displayed, once the payment is done, you will be routed back to the merchant page.

Q.

Q.

What if I change my mobile number, how can I link my Bank of Baroda RuPay Credit Card on UPI?

A.

If you have changed your mobile number, kindly update the same for your Bank of Baroda RuPay Credit Card as well. Once updated, kindly re-register the on UPI app.

Q.

Q.

Can I make payment to any person or other using the linked on UPI?

A.

No, only payment to merchant (P2M) will be allowed from the linked.

Q.

Q.

What are the restricted merchant categories on which customer won't be able to make payment using Bank of Baroda RuPay Credit Card on UPI?

A.

Restricted categories: UPI transactions won't be allowed on

- a. International merchants/websites.

- b. P2P (Peer to Peer i.e. MCC code - 0000)

- c. P2PM (Peer to Peer Merchant i.e. MCC Code - 7407)

- d. Digital account opening (MCC Code: 7409)

- e. Lending platform (MCC code: 7408)

- f. Cash withdrawal at merchant (Payee MCC Code: 6010)

- g. Cash withdrawal at ATM

- h. ERUPI (UPI voucher for government subsidy etc)

- i. IPO (Purpose code: 01, MCC code: 6211)

- j. Foreign Inward Remittances

- k. Mutual Funds

- l. MCC Restricted for CC on UPI are as under

- 0000 - P2P (Peer to Peer)

- 4829 - wire transfers/money orders

- 6010 - Financial institutions - manual cash disbursements

- 6011 - Financial institutions - automated cash disbursements

- 6012 - Financial institutions - merchandise and services

- 6013 - Cash withdrawal thru ICCW (interoperable cardless cash withdrawal)

- 6051 - Non-financial institutions - foreign currency, money orders (not wire transfer), scrip and travellers' checks

- 6211 - Securities - brokers and dealers/IPO

- 7322 - Debt collection agencies

- 7407 - P2PM (peer to peer merchant)

- 7408 - Lending Platform

- 7409 - Digital account opening

- 7800 - Govt Owned Lottery

- 7801 - Govt Licensed Casinos

- 7802 - Govt Licensed Dog/Horse racing

- 7995 - Betting, including lottery tickets, casino gaming chips, off-track betting and wagers at race tracks

- 9406 - Govt owned Lottery

- m. Any other categories as restricted by BFSL from time to time.

Q.

Q.

Can I link my Bank of Baroda Visa/ Mastercard Credit Card on UPI?

A.

Currently, only RuPay Credit Card can be linked on UPI.

Q.

Q.

What are the number of transactions allowed from linked on UPI?

A.

There is no limit for the number of transactions carried out from linked on UPI.

Q.

Q.

Is there any limit on the amount of transaction that can be carried out from linked on UPI?

A.

There is no limit for the number of transactions carried out from linked on UPI.

- First 24 hours of linking the credit card in UPI App - Amount limit per day per card is Rs.5,000

- After 24 hours of linking the card in UPI App

- Amount limit per card per day can be upto UPI limit i.e. 1 lakh per day

- Please note - UPI limit is 2 lakh per day for some special MCC codes i.e 5960, 6300 & 6529

- Restricted categories: UPI transactions wont be allowed on

- International merchants/websites.

- P2P (Peer to Peer i.e. MCC code - 0000)

- P2PM (Peer to Peer Merchant i.e. MCC Code - 7407)

- Digital account opening (MCC Code: 7409)

- Lending platform (MCC code: 7408)

- Cash withdrawal at merchant (Payee MCC Code: 6010)

- Cash withdrawal at ATM

- ERUPI (UPI voucher for government subsidy etc)

- IPO (Purpose code: 01, MCC code: 6211)

- Foreign Inward Remittances

- Mutual Funds

- MCC Restricted for CC on UPI are as under

- 0000 - P2P (Peer to Peer)

- 4829 - wire transfers/money orders

- 6010 - Financial institutions - manual cash disbursements

- 6011 - Financial institutions - automated cash disbursements

- 6012 - Financial institutions - merchandise and services

- 6013 - Cash withdrawal thru ICCW (interoperable cardless cash withdrawal)

- 6051 - Non-financial institutions - foreign currency, money orders (not wire transfer), scrip and travellers' checks

- 6211 - Securities - brokers and dealers/IPO

- 7322 - Debt collection agencies

- 7407 - P2PM (peer to peer merchant)

- 7408 - Lending Platform

- 7409 - Digital account opening

- 7800 - Govt Owned Lottery

- 7801 - Govt Licensed Casinos

- 7802 - Govt Licensed Dog/Horse racing

- 7995 - Betting, including lottery tickets, casino gaming chips, off-track betting and wagers at race tracks

- 9406 - Govt owned Lottery

- Any other categories as restricted by BFSL from time to time.

- However, it will be subject to the available credit limit on your Bank of Baroda Credit Card.

Q.

Q.

Will I be charged for linking or carrying out any transaction from linked on UPI?

A.

Customers will not be charged for linking or carrying out any transaction from the linked on UPI.

Q.

Q.

Can I make my linked as default account to receive funds?

A.

Funds cannot be received on linked on UPI.

Q.

Q.

Do I need to enable card controls on Bank of Baroda RuPay Credit Card to use for online or contactless transactions?

A.

Yes, Customer needs to enable Bank of Baroda RuPay Credit Card using card controls (eCommerce, contactless etc) separately before making such type of transaction

using CC / CC on UPI.

Q.

Q.

If my Bank of Baroda RuPay Credit Card is renewed, do I need to link it again in UPI?

A.

Yes, if your Bank of Baroda RuPay Credit Card is renewed/replaced, customer needs to re-register in UPI with updated details

Q.

Q.

Where can I see my Bank of Baroda RuPay Credit Card transactions happened through UPI platform?

A.

Bank of Baroda RuPay Credit Card transactions through UPI platform can be viewed in Bank of Baroda RuPay Credit Card statements every month

Q.

Q.

Will I earn any reward points for UPI spends using Bank of Baroda RuPay Credit Card?

A.

Yes, CC on UPI transactions will earn only core reward points as specified in below table

| Product Name |

RP on special MCCs* |

RP on spends at other MCCs |

| RuPay Easy |

0.5 RP per Rs. 100 |

1 RP per Rs. 100 |

| RuPay Premier |

1 RP per Rs. 100 |

2 RP per Rs. 100 |

| RuPay Business empower |

0.5 RP per Rs. 100 |

1 RP for Rs. 100 |

| RuPay ICAI Exclusive |

1 RP for Rs. 100 |

1 RP per Rs. 100 |

| RuPay ICSI Diamond |

1 RP for Rs. 100 |

1 RP for Rs. 100 |

| RuPay CMA one |

1 RP for Rs. 100 |

1 RP for Rs. 100 |

| RuPay IRCTC |

2 RP for Rs. 100 |

2 RP for Rs. 100 |

| RuPay Snapdeal |

4 RP for Rs. 100 |

4 RP for Rs. 100 |

| RuPay HPCL Energie |

2 RP for Rs. 150 |

2 RP for Rs. 150 |

| RuPay Varunah |

1 RP for Rs. 100 |

1 RP for Rs. 100 |

| RuPay Varunah Plus |

2 RP for Rs. 100 |

2 RP for Rs. 100 |

| RuPay Varunah Premium |

3 RP for Rs. 100 |

3 RP for Rs. 100 |

| RuPay Rakshmah |

2 RP for Rs. 100 |

2 RP for Rs. 100 |

| RuPay The Sentinel |

2 RP for Rs. 100 |

2 RP for Rs. 100 |

| RuPay Indian Army Yoddha |

2 RP for Rs. 100 |

2 RP for Rs. 100 |

| RuPay Vikram |

1 RP for Rs. 100 |

1 RP for Rs. 100 |

| RuPay Renaissance - Nainital Bank |

1 RP for Rs. 100 |

1 RP for Rs. 100 |

| RuPay Pragati (BRKGB, BUPB, BGGB) |

1 RP for Rs. 100 |

1 RP for Rs. 100 |

*Refer website MITC section for T&C applicable on rewards program & list of special MCCs

Q.

Q.

Is there any capping on the reward points that can be earned on UPI spends through RuPay?

A.

Maximum of 500 reward points can be earned in a Statement cycle on UPI spends through RuPay.

Q.

Q.

Will I get any surcharge waiver on fuel purchases done using RuPay via UPI mode?

A.

Fuel surcharge applied on fuel txns done using CC on UPI, will reflect as separate transaction in credit card statement.

- Fuel surcharge waiver benefit will applicable to all Fuel txns done using Credit Card as follows

- IRCTC Cobrand Credit Card: 1% of fuel transaction amount surcharge waived for fuel transactions between Rs. 500 to Rs. 3000 (subject to maximum of Rs. 100 per statement)

- Varunah (base variant): 1% of fuel transaction amount surcharge waived for fuel transactions between Rs. 400 to Rs. 5000 (subject to maximum of Rs. 100 per statement)

- HPCL Cobrand Credit card: 1% of fuel transaction amount surcharge waived for fuel transactions done only at HPCL fuel stations between Rs. 400 to Rs. 5000 (subject

to maximum of Rs. 100 per statement)

- All other credit cards: 1% of fuel transaction amount surcharge waived for fuel transactions between Rs. 400 to Rs. 5000 (subject to maximum of Rs. 250 per statement).

- Please note Fuel surcharge waiver capping is per card per statement cycle, & it’s applicable to all transactions i.e. irrespective of mode of transaction like credit card

swipe at POS machine or fuel transaction done through UPI App by scanning the dynamic QR code on POS machine at the fuel station.

Please note -

- 1. Fuel surcharge is levied by the acquiring bank/network partners on all fuel transactions.

- 2. In case of swipe or contactless fuel transactions done using Credit Card, the surcharge amount is added to the fuel transaction by acquiring bank & thus only 1 transaction

reflects in monthly Credit card statement.

- 3. However, in case of Credit Card on UPI fuel transactions ‑ The fuel surcharge is billed/settled by the acquiring bank/network partner separately, thus 2 transactions (1 for

actual fuel

purchase & 1 for Fuel surcharge) will reflect in your monthly credit card statement.